Homeowners Insurance in and around Atlanta

Looking for homeowners insurance in Atlanta?

The key to great homeowners insurance.

Would you like to create a personalized homeowners quote?

What's More Important Than A Secure Home?

Committing to homeownership is a big responsibility. You need to consider home layout location and more. But once you find the perfect place to call home, you also need outstanding insurance. Finding the right coverage can help your Atlanta home be a sweet place to be.

Looking for homeowners insurance in Atlanta?

The key to great homeowners insurance.

Protect Your Home Sweet Home

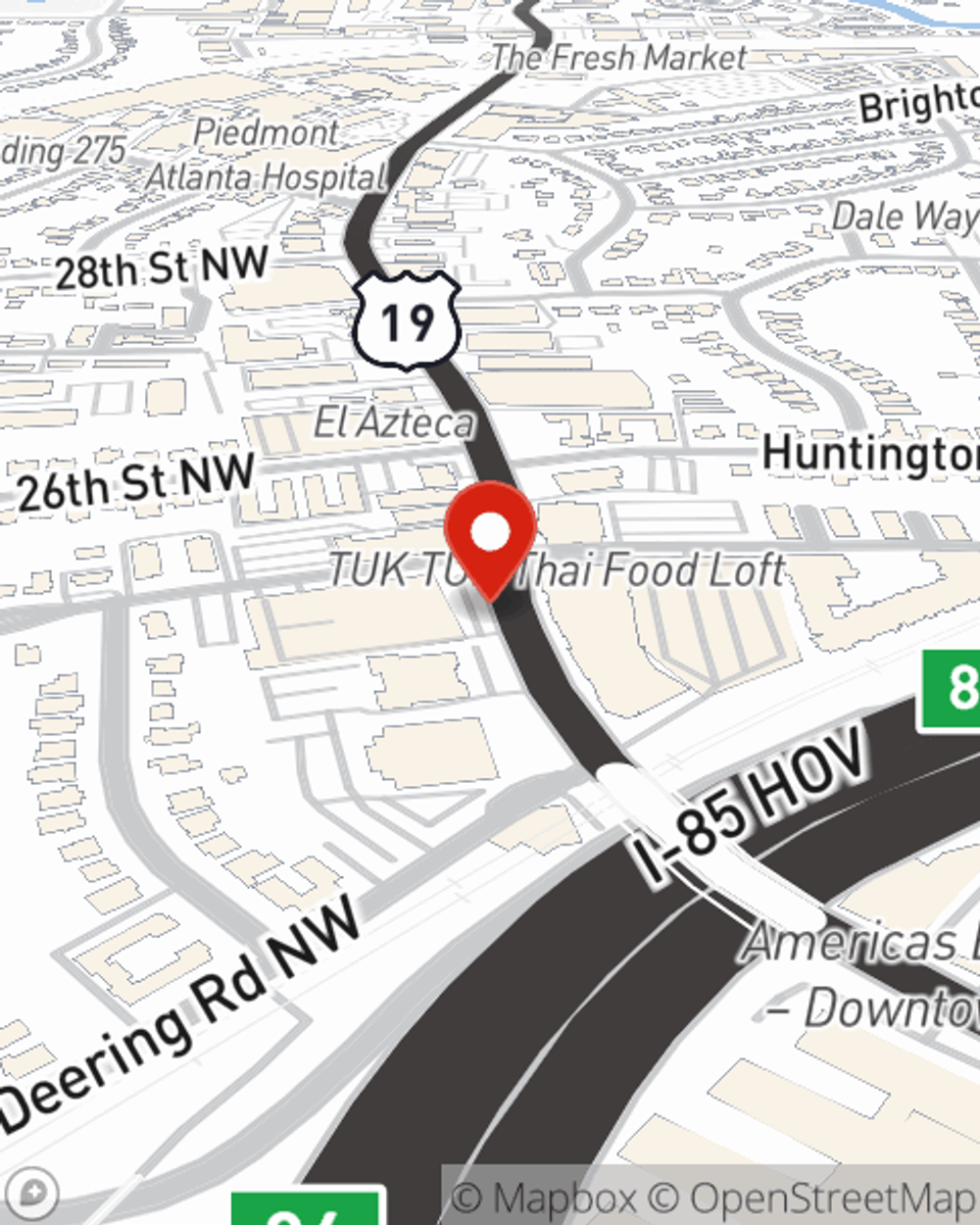

State Farm's homeowners insurance safeguards your home and your memorabilia. Agent Cleo Meyer is here to help set you up with a plan with your specific needs in mind.

Having excellent homeowners insurance can be invaluable to have for when the unpredictable arises. Reach out to agent Cleo Meyer's office today to get the home coverage you need.

Have More Questions About Homeowners Insurance?

Call Cleo at (404) 817-0960 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Moving? Don't forget to make insurance changes, too

Moving? Don't forget to make insurance changes, too

Before you move, talk with your agent about move insurance and moving your current policies. Read why transferring insurance is so important.

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

Simple Insights®

Moving? Don't forget to make insurance changes, too

Moving? Don't forget to make insurance changes, too

Before you move, talk with your agent about move insurance and moving your current policies. Read why transferring insurance is so important.

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.